Comprehensive Services for Every Stage of Life

Learn More About Our Approach

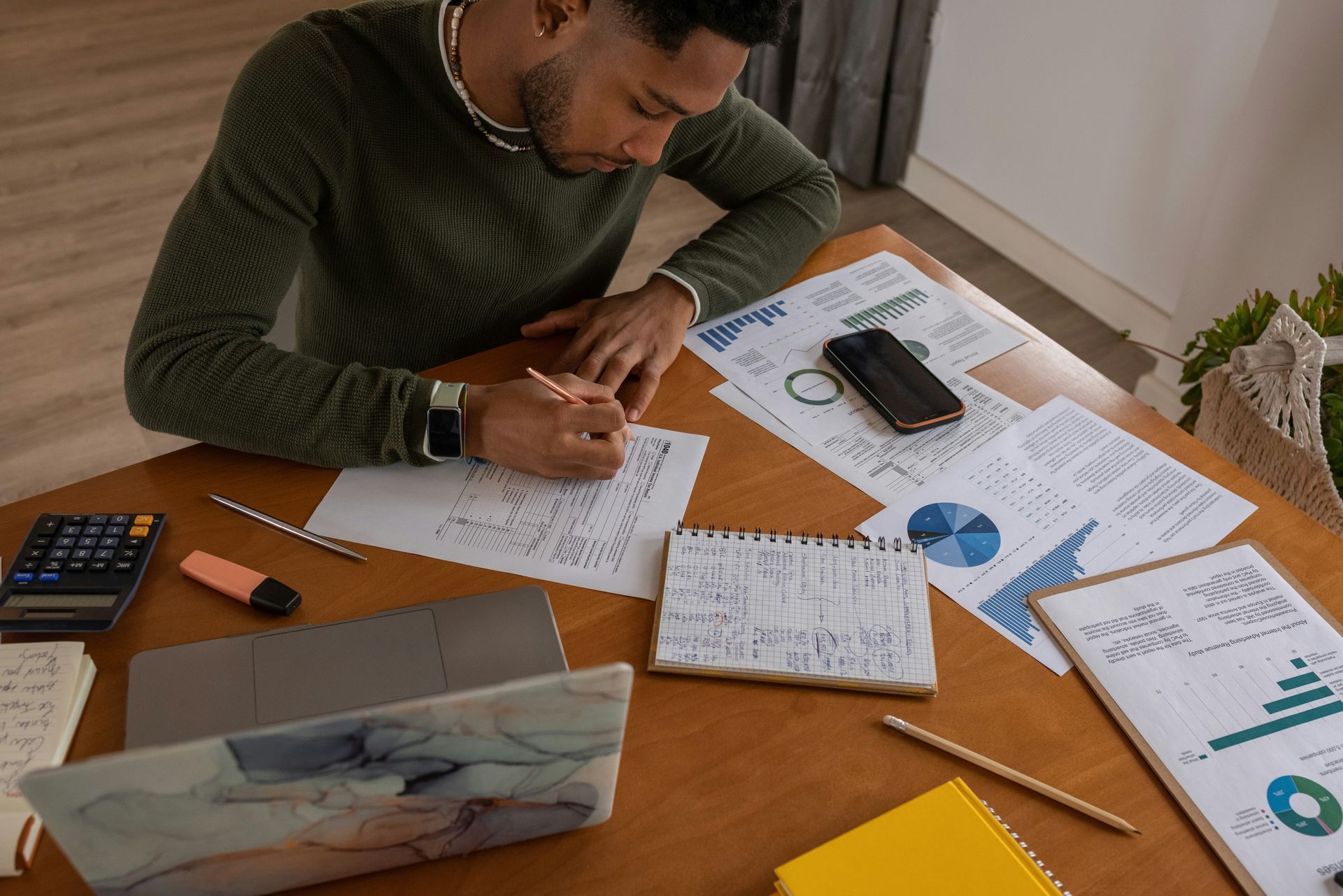

Building Trust, Finding Clarity

At the heart of our work is trust—a value we've upheld since our founding in 1995. Money and investments are tools, but the true measure of success is the confidence and security we bring to your life. Through our fee-based advisory or subscription-based service and commitment to long-term partnerships, we help you create a financial future that aligns with your dreams and values.